India’s Ministry of New & Renewable Energy (MNRE) published the ALMM, which stands for the Approved List of Models and Manufacturers, that specifies which Solar photovoltaic (PV) modules and cells are approved for use in government projects, subsidy schemes, and certain tenders, to help achieve India’s ambitious renewable target of 500 GW of non-fossil capacity by 2030. This policy altered the solar manufacturing landscape. Although there are so many questions you people might have with this detailed blog, I am trying to answer all your questions, and the key questions are-

What is ALMM?

Why is it important for the solar industry?

How can it transform our solar manufacturing landscape?

In this context, what exactly are List I and List II?

Examine the concerns that arise from the policy.

Discuss the new provisions included in this policy.

What is ALMM?

–The ALMM policy was introduced by the Ministry of New and Renewable Energy (MNRE) on 2 January 2019. The policy established a mandatory registry of approved solar PV module and cell manufacturers whose products meet stringent quality, traceability, and performance benchmarks. The objective of this framework is to establish quality checks, ensuring that only certified and reliable equipment is used in government-sponsored projects.

This ALMM serves as a non-tariff barrier to low-cost imports, especially from China. However, the policy also supports the Atmanirbhar Bharat (Self-Reliant India) initiative by creating captive demand for domestic manufacturers.

The ALMM policy proposed two Lists:

List I — Solar PV Module(Manufacturers)

List I was published for Solar PV modules and implemented on 10th March 2021, with a capacity of 8.2 GW from 21 manufacturers. However, the government suspended the mandate due to a lack of domestic capacity in March 2023 for projects commissioned by March 2024. But, comprehensively reinstated on 1 April 2024 through this policy, the Indian government imposed Bureau of Indian Standards (BIS) certification for government-tendered utility-scale solar projects, rooftop solar (net-metering), the corporate PPA market, as well as government schemes (KUSUM).

List-II— Solar PV Cell (Manufacturers)

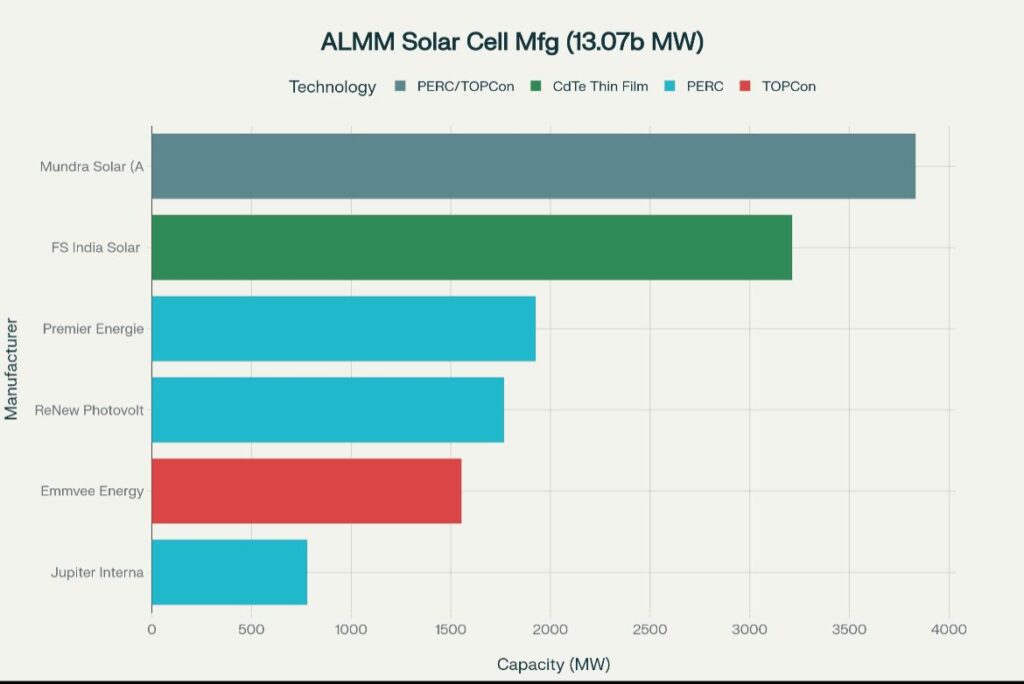

The government published the first ALMM List-II for solar cells, listing 13,067 MW of domestic cell manufacturing capacity across six manufacturers. ALMM List-II became effective for tenders on September 1, 2025 and for project commissioning on June 1, 2026. This development represents a critical step toward vertical integration of India’s solar supply chain, addressing the current reliance on imported cells for domestic module assembly.

Impact of ALMM on Solar Imports and Market Dynamics in India

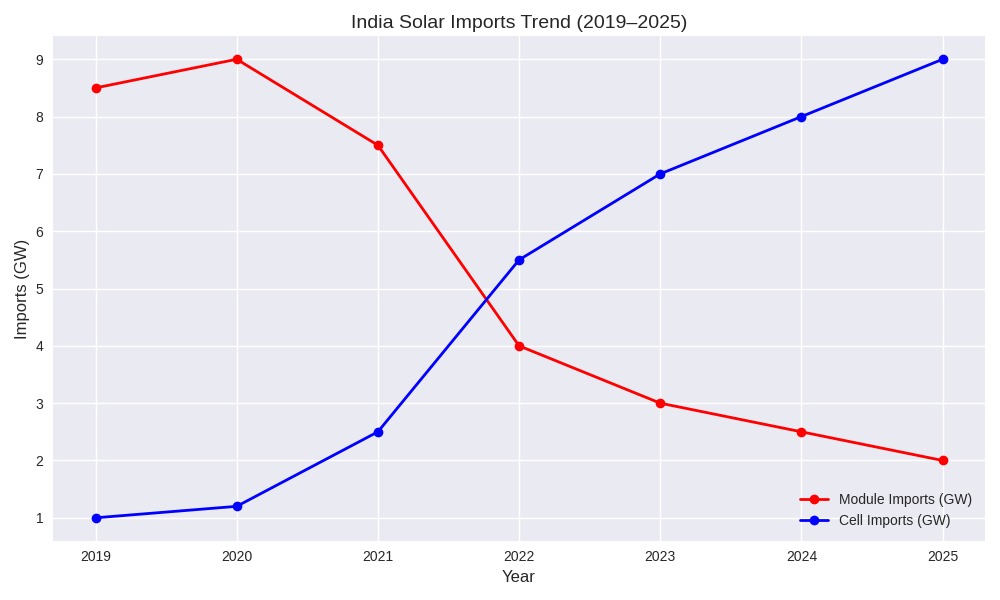

The mission of the Indian government behind this ALMM list is to catalyse domestic manufacturing. As per the 2021 trade data, India imported $3.52 billion worth of solar modules and cells annually.

We were dependent on many countries, but China supplied the bulk of solar modules and cells, accounting for around 70% to 80%. Domestic contribution was very low, around 30% and limited to module assembly, not to cell production.

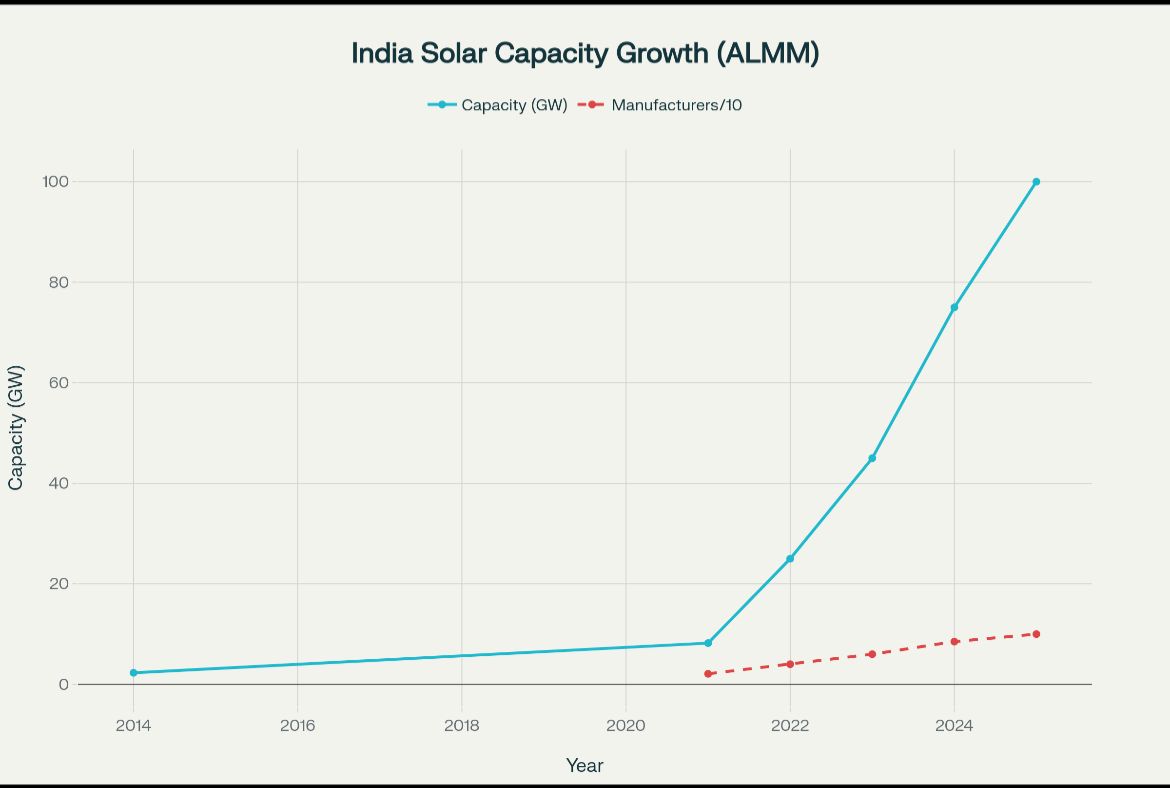

Solar module manufacturing capacity under ALMM experienced exponential growth starting from 2.3 GW in 2014, after the first list was published in 2021 then accelerated to achieve 100 GW by 2025. Although the number of registered manufacturers has similarly expanded from 21 in 2021 to 100 by 2025, operating 123 manufacturing facilities across the country

Short-term Challenges and Disruptions

Opportunities and challenges are the two sides of the same coin, so the implementation of the ALMM policy has generated mixed responses from solar project developers and EPC contractors.

Procurement Challenges

Developers are facing challenges of module scarcity after the ALMM policy implementation during peak time. Rajasthan and Gujarat experienced delays of 3-5 weeks in 2024 due to the scarcity of modules from approved vendors.

Cost Implications

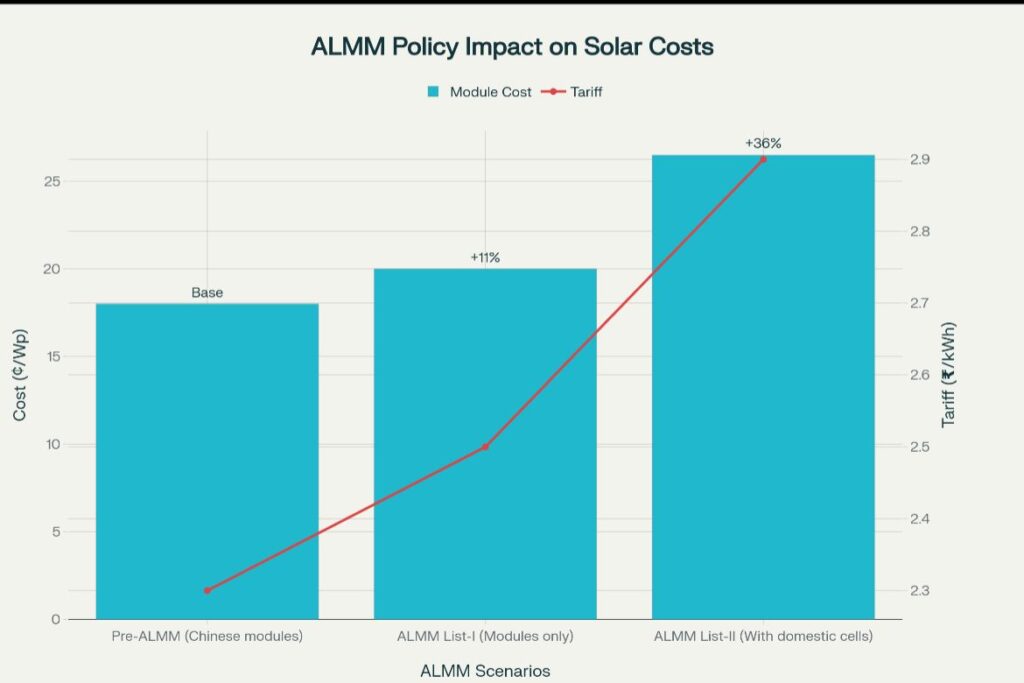

This policy may lead to a monopolistic condition because the ALMM mandate removes pricing competition from international suppliers. There is a significant concern that domestic manufacturers can command premium pricing, and project costs have risen by 3–5%.

Project Timelines

There is a difference between total manufacturing capacity and ALMM’s approved capacity. Although the module manufacturing capacity reached 64.5 GW by December 2023, only 37.42 GW is listed under the ALMM policy list. Now it may lead to false scarcity, so developers and EPC providers have to take care of this and manage supplier relationships.

Benefits and Purpose of the ALMM Policy

There is a very sharp vision behind this policy implementation that ensures India’s solar infrastructure reliability and performance.

Quality Assurance

India has such huge diversity not only in terms of population but also in climatic conditions. These ALMM-certified modules will ensure reliability because this policy requires various evaluation processes, such as heat resistance, UV endurance, various climatic conditions, and mechanical stress tolerance. After this quality assurance check, and BIS certification helps to ensure approximately 25+ years of operational lifespan.

Boost to Domestic Manufacturing

The Indian government under Atmanirbhar Bharat promotes domestic manufacturing through this policy. The government wants to slow down imports from foreign countries and ensure domestic manufacturing in our country. And we drastically reduced the import from 2014 to 2015. This policy reduces foreign suppliers and strives to achieve self self-reliant India.

Long-Term Cost Stability

The objective of this ALMM policy is long-term saving, while the short-term cost may rise. However, in the bigger picture, after this policy implementation, it will give India cost stability through quality assurance and will provide reliability and domestic manufacturing scaled up, policy supply chain resilience, investor confidence, and also the PIL schemes will help to gain cost stability.

Future Outlook and Strategic Implications

With 100 manufacturers and 123 factories now listed under List-I, the policy is marked as a game-changer for India’s solar landscape.

India’s solar manufacturing policy framework represents the implementation of ALMM List-II for solar cells from June 2026. As we see that List-II is related to cell manufacturing, and the Current domestic cell manufacturing capacity of 13 GW, which could reach 40-45 GW annually between 2027 and 2030.

However, to tackle ALMM List-II Implementation, Market participants are adopting diverse strategies, like Saatvik Green Energy, which is making substantial investments in integrated manufacturing with 4.8 GW cell capacity and 4 GW module capacity planned for operation by FY2026- 27.

Conclusion

Yet India is ready to become a player in the global solar trade with the ALMM policy. There is a substantial increase in manufacturing capacity, which provides a foundation for domestic supply security and the export market. This policy drives self-reliance and high-quality manufacturing.

The United States has emerged as a primary market for Indian solar modules, with export values increasing from ₹1,100 crores in 2021 to ₹4,640 crores in 2022, driven partly by sanctions on Chinese imports. However, we are going to achieve a sustainable future with energy security. Continued policy support through mechanisms like the PLI scheme, coupled with industry investments in advanced technologies, will be critical for maintaining momentum in domestic manufacturing development.